Banks and building societies are refusing to lend on about one in five properties because of down-valuations by their surveyors.

But the issue raises fundamental questions: Is it over-valuing by agents or under-valuing by surveyors that is wrecking so many deals? Or is it a mixture of both?

According to Spicerhaart boss Paul Smith, in around 19% of cases, lenders’ surveyors are valuing properties at below the agreed sale price.

This is leading to chains breaking and sales collapsing, says Smith, worsening the stagnation of today’s property market.

“Should we therefore be getting properties pre-valued by surveyors?” asks Smith somewhat provocatively in his column which appears on EYE today.

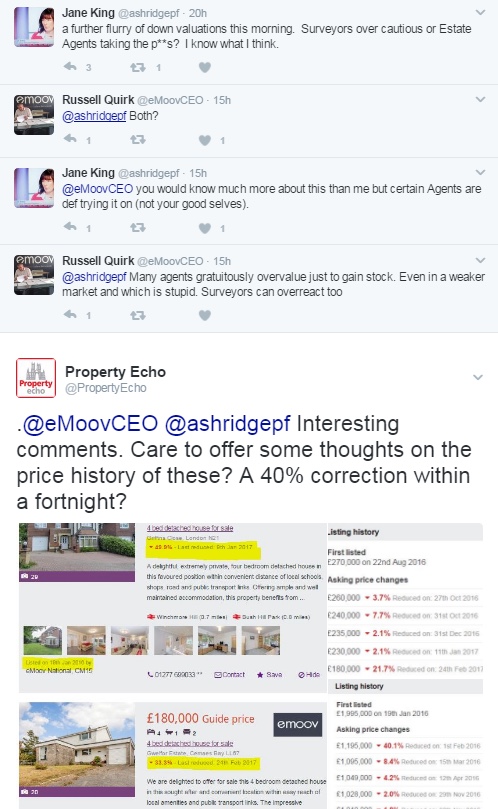

Just as provocative was an exchange on Twitter yesterday in which agent Jane King remarked on a “further flurry of down valuations . . . Surveyors over cautious or estate agents taking the p***?”

Russell Quirk, of eMoov, countered: “Many agents gratuitously over value just to gain stock. Even in a weaker market which is stupid. Surveyors can over-react too.”

The Property Echo, based in Lincolnshire, then posts up a couple of eMoov properties and asks whether their prices will receive a “40% correction within a fortnight”.

A less than amused Quirk snaps back: “Haven’t you got anything better to do?”

The exchange continued with Property Echo asking: “Will you withdraw/amend your comment that ‘agents gratuitously overvalue’ or do you stand by your comment?”

Meanwhile, news agency Bloomberg yesterday reported that London home owners “are desperately slashing prices”.

The story uses Zoopla figures which show that the percentage of asking prices that have been cut rose in 30 out of 32 London boroughs between last July and this January.

Across the country, says Zoopla, almost one-third of homes listed on its site have been reduced in price at least once.

The biggest average reduction is almost £121,000 in Barnet, north London. The second biggest average drop is Coventry, at £27,320.

Almost half of all properties listed in St Helens (43.7%), Hartlepool (42.5%) and Middlesbrough (40%) are currently marked down.

The saying goes, it’s only worth what someone is prepared to pay.

If they are prepared to pay it, then that’s what it’s worth

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

A selling agent can’t be sued for over-valuing, but a valuer certainly can! The problem is that what someone is prepared to pay in February 2017, based on current mortgage availability and rates, may not be what someone is prepared to pay in 2020 if all the cheap money has gone and rates have gone up by +/- 2%…. Banks are not only anticipating their exposure to negative equity in future, but also the hassle of a defaulting borrower.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Not so see definition below. Valuer’s go with the view of risk to the mortgage lender but all too often take the view of what they think it is worth, often founded on poor judgement and knowledge. I can write a book on poor lenders valuations, as most agents can. Strange that one valuer down values only for another to say it was OK on a resale or lender switch. One of them was wrong!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

This demonstrates and no offence intended, the lack of knowledge in the Estate Agency profession in respect of valuations.

Okay firstly what something is ‘worth’ is totally separate to what the Market Value may be!. So using this simple example, your buyer wants to live next door to his son (I’ve had this example) and is therefore willing to pay a higher price for the property to do so. The ‘worth’ to that particular buyer is higher than the Market Value, i.e. the value others would pay for that particular property at that point in the market cycle.

Really, Estate Agents need to get a grip and stop trying to accuse Valuer’s of incompetence just because they don’t agree with you.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Interesting, I’m an estate agent and I’m a little mystified by your repeated apparent reliance on comparable evidence.

Comparables valuation are only as good as the volume of comparables, if there are no comparable sales is a property worth nothing at all or what a purchaser has agreed with the vendor?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

steps56

A property is worth what a buyer is prepared to pay for it as long as they can raise the finance.

If a property transaction actually completes – then that is the ‘value’ of the property on the day the sale was agreed.

Tomorrow is another day – and tomorrow’s value is yet to be established.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

How niave, and that would be your stance when talking to the surveyor hmmm and how ridiculous to suggest it’s time for surveyors to pre value! They don’t have a clue, they ask local agents for comps if they can’t find a relevant ‘copy’ on a portal but maybe you want to drum up business for your other departments!! We have always been in this chicken and egg situation and largely we have survived but the local knowledge is being eroded by the lazy, unprofessional, desperate or just the agent that is prepared to spread his wings to anywhere without the proper care or service and that isn’t just online people.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I bet Robert’s system can identify those companies responsible for the highest numbers of sale price reductions and therefore over-valuing initially. There is no doubt that it can adversely affect the vendor’s final end result.

I wonder who would do it if we all had to declare the percentage of listings we had to reduce in marketing price? Would anyone out there be willing to do that, to help eliminate the deliberate practicing of over-valuing?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Sorry, there is no such thing as ‘over valuing’ either! The agent’s job is to undertake a fair market appraisal and market the property at that level. If someone is willing to pay that price then that’s an indication of the worth to that buyer, but not necessarily reflective of the market value, see previous response to post above.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Two observations:

1 The Lincolnshire Property Echo has a point. Who is more likely to over value to get an instruction, a ‘high street’ agent where they won’t earn a penny if it doesn’t sell or an online agent who get’s paid whether it’s sold or not?

2 Who is most likely to value a property more accurately, an estate agent in the nearest town who is dealing with that area and that area only day in day out or an online agent who is 120 miles away and just sits in front of laptop to work out the asking price?

Know where my money (or property) would be . . . .

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

If only agents are only 4% of the market then it is high street agents that are the cause of this not online agents

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

observer

I concede that you almost have a point there.

I’m sure you don’t want to read a post that would make ‘War and Peace’ look like a Readers Digest novelette, but there are a million arguments on each side of the fence regarding the thorny subject of ‘valuations’ and how/why Agents come up with their figures. So I won’t risk boring your ‘nads off with it.

BUT – I will say this. Overvaluing is an art – and like every other art form – some don’t even try their hand at it, and some are far, far better at it than others.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Okay let’s cut to the chase. It’s an Estate Agent’s role to push the sale price (their ‘market appraisal’ figure as high as they can, both for their own benefit and for that of their client. it’s NOT a valuation as such, but their OPINION on the figure at which they may best achieve a sale for their client. Now we’ve all heard tales of agents who give misleading advice to their clients, i.e. sell it cheap so a quick sale (even possibly to a friend, family member and/or developer partner), as well as agents who push the market. The latter may well be due to testing the market in a particular area, the Vendor INSISTING on a particular price or simply it’s an unusual property.

Now we rarely hear talk about the above practices and I wonder why that is? But what we do hear is Estate Agents using the phrase DOWN VALUATION which is a NONSENSE phrase. There’s no such thing and I’ll explain why.

Valuation is NOT an exact science, it’s a matter of opinion and it’s perfectly acceptable for 2 people (yes even registered valuers of which I am one) to have differing opinions about the same property, not ideal, but acceptable within tolerances. The Market Valuation for lending purposes is calculated in a particular way, using verifiable evidence.

I often hear agents say, “well there’s been loads of offers, I could have sold this 10 times over” etc… That’s great, but useless evidence as it’s simply hearsay and tainted by the fact that it’s the agent selling the property whom is saying it. If it’s that easy to prove the sale price, then supply the surveyor with some verifiable evidence, i.e. sales of similar properties in the last 6-12 months at most.

Agents YOU NEED TO HELP VALUERS. Some (unfortunately a high proportion in my experience) Estate Agents, in my experience, are unfortunately a bunch of lazy *********s They rarely want to provide comparable evidence to the valuer unless it’s asked for and then are often vague or try to provide evidence to support their position, even if that evidence is absolutely and obviously NOT comparable. Agents you need to see this as a TEAM effort and stop trying to trick or otherwise unduly influence the valuer.

My process is quite simple. I ask, prior to the inspection, for evidence as part of my initial contact with the agent (never yet received any in many years of adopting this practice, albeit some do provide when I collect keys to be fair but it’s more the exception), I undertake the inspection and gather my evidence. If it’s looking like I won’t be able to agree with the proposed sale price (which could BTW be to a SPECIAL PURCHASER for instance), I’ll request more comparables from the selling agent, as well as undertaking my own research. AGENTS RARELY SEND ANYTHING USEFUL but seem to mostly try to use comparables that are patently not comparable, sometimes many miles away from the subject.

If, after having asked twice (as well as my own research) I don’t have the evidence I need, then I value the property regardless.

Why is evidence so important? Well a valuation may not be challenged for many years at which time the agent’s ‘hearsay’ evidence is difficult to prove when challenged by a clever Barrister, whereas facts and evidence of actual sales, market trends, growth in an area and/or increasing values is more reliable.

SOLUTION:

Estate agents it’s time to realise, your job is to SELL the property and yes that includes doing some actual work to support your opinion! Get evidence together at the outset, why not track local market trends in a form that can be passed to the valuer, have at least 3 usable comparables with sale prices and dates on file with the property, work with the Valuer who after all is only doing her job rather than trying to rubbish their expert opinion (I know a lot of Valuer’s who have experienced such behaviours). Help your client sell their property, don’t simply sit back and hope for the best then complain when you don’t get what you want. I’ve come across, recently, some very aggresive agents and have even heard tales of threats and verbal abuse against Valuers.

Yes there will still be times when a Valuer doesn’t agree with you, that’s fine life isn’t about everyone agreeing. Your role then is to help the potential buyer understand why your client want’s to achieve their price, it’s called SALES and negotiation is at the forefront of that role!. Stop moaning and trying to blame others for what is patently your own lack of effort in most cases in my experience in any event.

Now there are some good agents who work well for their clients, but having covered the whole UK for over 20 years now buying and selling property, I’ve not found them to be the majority. It’s time for regulation of the Estate Agency industry, similar to the regulation an RICS Registered Valuer has to have. That might actually help improve the current system.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

A very interesting insight from the surveyors perspective. I agree, most agents (be honest) don’t provide comparables and competitives. If we’re not helping to guide the valuer to our way of thinking (on price) then we’ve got nobody but ourselves to blame.

We go out of our way to make sure we supply every valuer with evidence to substantiate our price. If you ain’t doing the same them don’t moan about down-valuations.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Wow you have a lot of time on your hands to write this very bitter sounding diatribe. Its a shame we are not all so time rich.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Seems you don’t have time, well do as I did! Learn to touch type as fast as most secretaries, have good systems and processes in place to ensure your business is compliant, efficient, provides excellent levels of service and I’m guessing by the fact you don’t have time to put a useful comment, that you’re one of those agents who CAN’T BE BOTHERED AS YOU DON’T HAVE TIME to do your job as well as a professional agent would.

Why do I have time? Here’s a tip. don’t waste your time writing nonsense and focus on the important things. It works wonders.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I did not spend the time on long drawn out response, as judging by your long and drawn out attack, painting all agents with the same brush I guessed that your mind was firmly made up.

I deal with many surveyors on a weekly basis, they come in many forms, as do agents, solicitors etc etc. Some are good, some are bad, some are terrible. I do not make a point of ranting about the bad ones and then assuming the rest will be similar.

I found the shouting in your rant quite rude, and incorrect.

For your information we are an agency who provides 3 comparables with each set of keys given to the surveyor to help them ( nice of us eh ? ) .

That’s if the surveyor has agreed to come to our office to collect the keys, rather than expect us to wait at the property between the time of 9-11 with the keys so he / she doesn’t have to drive them back to the office ( we are in a city centre and none of our properties are more then 5 miles away ) .

Then we have to explain to him how to get to the property, and usually watch his / her face in horror as we explain that they are going to have to pay for parking ! Yes we have had to pay for parking for each and every viewing, would you believe it ?

The surveyor then drops the keys back and explains “You could get a 4 bed detached where I’m from for that sort of money”. Oh well here comes another DOWN VALUATION – shouted that one just for your benefit.

Then they mark down the value at less than 5% difference of the agreed price, as of course surveyors can value a property to within 5%……….

Due to this, the deal falls through. We are back to square one, get paid nothing. And to top it all off we have to pay for more parking at viewings.

So there you go, I’ve had my rant back at you now …. happy ?

Luckily I don’t think that the majority of surveyors are like this, just a useless / lazy ( to coin a word used by yourself ) few. Most are very good and very thankful about the approach we take. And I would suggest most agents are very good. We deal with about 5 in our area, and 1 is not very nice to deal with, tutting and rolling his eyes when we ask him which property he is getting keys for, we just feel sorry for him as something else must be wrong in his life to be so angry all the time.

If you walk in somewhere expecting people to be bad, then your face and body language will tell them that before you open your mouth.

If you are nice and helpful then the agent will more than likely be nice and helpful back.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

No rant or offence intended, simply stating the facts as I’ve experienced over the last 20 years or so. I’m sure you have a different point of view and I respect that.

If, however, you are trying to say that Estate Agents don’t act as I’ve outlined above, then my friend you are living in a bubble that doesn’t exist outside of your universe I’m afraid.

I was not on the attack as you put it, simply pointing out a reasonable position and your response does again it seems to me, show that SOME Estate Agents feel attack is the best form of defence.

As I say, ill informed, poorly educated/trained Estate Agents who are being driven by commissions and Managers/owners demanding performance, may not have the time and/or inclination to do a thorough job as you and I seem to do.

As I say, not an attack, merely opening up discussion which I’m glad to say my rant (as you put it) had done so objective achieved. I say this as I’ve felt (as I know a lot of Valuers do), that this topic is long over due a proper discussion and the system should in my view be much more transparent and open. Rant over.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

You paint an interesting picture of your experience Surveyor and it all comes down to your line: Why is evidence so important? Well a valuation may not be challenged for many years at which time the agent’s ‘hearsay’ evidence is difficult to prove when challenged by a clever Barrister…

Be honest. The ‘valuation’ is in reality nothing more than a CYA process. (Cover Your A*se). The lender wants to cover theirs to protect their loan; the surveyor want to cover theirs to avoid the risk of being sued. It used to be that lenders treated interest as the reward for their risk. Now they want insurances, no-risk valuations, belt, braces and anything else they can think of to minimise their risk.

Before the lenders got over-greedy and severely burned their fingers in the 1990s recessions it was possible for agents to work constructively with surveyors in arriving at sensible, practical mortgage valuations. But when the rules changed no surveyor was ever going to stick their neck out and ‘take a view’. It is now all about CYA.

Don’t be surprised that agents get hacked off with the rules made flesh in the form of surveyors. Insisting as some do on only taking comps of properties that have completed means you are almost always looking at how the market was months ago, not necessarily how it is now. Supply and demand can change very quickly. A mortgage valuation is nothing more than a snapshot in time and an educated guess at what will happen in the future. A degree of common sense would go a very long way to improving the current situation. But it won’t happen.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I take your point and having worked for the largest surveying firms in the country over the years, undertaking all types of valuations I have to agree that the current system is certainly not ideal.

I mean, how can it be an ideal system where a valuer is reliant upon information provided by those who have such a vested interest in the sale, i.e. the agent selling the property! This can be particularly noticeable in small towns, etc.. where there may well be only 1 or 2 agents who, let’s be honest, have a vested interest in driving up prices.

What’s wrong with that you shout. Nothing I suppose, but let’s imagine the situation whereby a special purchaser buys a house for say £100k more than the current evidence supports (I have actual experience of such a situation). Does that now mean that the whole area is £100k higher for similar properties, of course not. But in such a scenario and unscrupulous agent would try to use that as evidence I’m sure and as such the Valuer would likely be accused of downvaluing or worse.

the point on market evidence being dated is a fair one, but unfortunately not one a Valuer can influence as the Courts require (oh yes we’re subject to the legal system much more than you Estate Agents are in respect of valuations), us to have such evidence and whilst you may consider that Covering our ****, I’d say it’s us being professional and ensuring that the client is given a fair market valuation which is supported by evidence rather than simply hearsay.

In closing I am not anti Estate Agent, simply anti Estate Agents who constantly bang on and use nonsense phrases such as ‘Down Valuations’. the system we have to work within is an imperfect one, stop trying to rubbish the surveyors and accept it’s a part of the sale process, help surveyors help you, provide evidence and reasonable argument to support your case, rather than simply (which is what I’ve unfortunately experienced on occasion) trying to adopt tactics which are certainly not professional.

You can STICK YOUR NECK OUT as you have limited liability. Whilst a professional valuer will try their best to provide a fair and reasonable Market Valuation, based upon the rules they have to work within, it is not their role to take risks or as you state try to predict the future. Hope this helps stop Valuer abuse, but I doubt it having met too many poorly trained, ill educated and certainly under regulated Estate Agents over the years.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Thanks for the response Surveyor but I must take you very strongly to task for suggesting that agents ‘have a vested interest in driving up prices’. With respect, nonsense.

In my very long career I have never seen anything to demonstrate that agents ‘drive up the market’. Greedy vendors, over optimistic buyers yes. Agents, no.

Given that most agents operate at around the 1% fee level, a difference of even £5,000 in an achieved price is pretty immaterial to their income in the overall scheme of things.

Even if they had the means – which they don’t – the effort and cost of ‘driving up the market’ to any significant degree would be prohibitive.

Agents simply want the sale to go through. Period.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Okay so you would say that an agent who wishes to get her boards up in a particular street or village say has never told a Vendor one price and then dropped it later so they have secured both the instruction and more importantly the free advertising and additional business that board has provided them with.

Really, do you think I’m that naive and inexperienced to listen and/or believe such twoddle? Come on, at least be honest with yourself if not others on this board!

Sorry to be blunt, but your post warrants it in my view.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

You know what Surveyor, I was quite liking you up to this point…

In answer to your question; It has and it does happen and on occasion it might just work in the vendor’s favour when a buyer chooses to purchase at the higher figure. But then of course the mortgage valuing surveyor comes along and blows the perfectly good deal out of the water…

I don’t know how many times this may happen.What I do know is this. I know an awful lot more about the inner workings of estate agency than you seem to.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“… the free advertising and additional business that board has provided them with.”

AHHH… the old “boards breed boards” analogy.

I have a different slant, Surveyor (no surprises there, I guess)

A ‘For Sale’ board advertises the property.

A ‘SOLD (StC)’ board advertises the Agent.

The latter is something that SOME Surveyors seem hellbent on having returned to the former as a direct result of their visit.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Well said PeeBee.

There is also the very common scenario of the valuer (that’s the estate agent) saying – The place could achieve between £275,000 and £285,000, we will try it at say £290,000 for a couple of weeks and then modify the asking price if necessary.

I suspect Surveyor will be along some time soon to allege that this good practice is all about driving up the estate agent’s commission take.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I’m honest and realistic, i.e. I accept that some valuer’s may well not be as consistent as others in their approach and may well be even more conservative in their valuations than others.

It’s a shame that once again you seem to only want to show how important you are compared to others, I mean just accept that some of your profession may not act as well as they should, BE HONEST with yourself and this board. Your arrogance is I’m sorry to say typical of a lot of agents I meet, I mean “I can’t be wrong because I’m the Estate Agent” or whatever. NONSENSE.

Until you guys are honest with yourselves and start to realise it’s not a THEM AND US situation, we’ll never progress which it seems to me a lot of agents don’t want to in any event as they are happy being arrogant.

Shame. Last post I’m going to make on this subject, I don’t mind talking to a brick wall, but I’m damned if I’ll continue shouting at it!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Rather a shame if you choose to interpret the imparting of fact as a statement of ‘importance’ or ‘arrogance’.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“…I accept that some valuer’s may well not be as consistent as others in their approach and may well be even more conservative in their valuations than others.”

So you actually accept everything that is being said – that valuers can and do value a property at a lesser figure than other, equally, more – or even LESS able, experienced or qualified valuers would?

You just don’t like it being called a downvaluation.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I note your upper case comments “Agents” must do this and do that. Are YOU not supposed to know without agents input? Your supposed to be independent and good at your job. What you are saying is you don’t know property value without the help from agents? and I see a hint of you know best when it comes to valuations, not agents. You may be right in some circumstances but more often than not an over valued asking price doesn’t sell until the price is reduced during marketing or a lower offer accepted. Agents job is to get the best possible price and that is written in law. Your job is to advise your client (the lender) of condition and opinion on value and it is for them to consider if THEY wish to lend based on loan to agreed sale value, unless of course your doing a home buyers report which is more often than not …. war and peace of scarring the hell out of buyers while covering your back from litigation? Just like in estate agency, there is the good, the bad and the ugly, surveyors.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Surveyor

“But what we do hear is Estate Agents using the phrase DOWN VALUATION which is a NONSENSE phrase. There’s no such thing and I’ll explain why.”

Funny, that – one of the UKs biggest lenders seem to have a different opinion:

http://www.nationwide.co.uk/guides/news/articles/2014/11/things-that-could-stop-a-house-purchase

Have we had this discussion before?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

PeeBee

Respect to you, well found and I have to say it’s good to see someone back up an argument with facts!

That said, they are WRONG! and I don’t care who they are (Nationwide or otherwise). I mean, how can something be down-valued when it has not been valued in the first place? The Estate Agent provides a Market Appraisal and NOT valuation so as such how can a down-valuation occur? Also valuation is an opinion, so as someone says, 5% tolerance is not a down-valuation, it’s a difference of opinion.

Now as a professional Estate Agent, which I’m sure you and all the others banging on about this topic here are, you’ll be FULLY conversant with the Code of Practice that you should be adhering to, i.e. Guidance on Property Sales, produced by the Trading Standards.

Now, having reviewed guidelines, I find NO reference to the phrase valuation and as such am confused as to why Estate Agents keep saying they provide a valuation, are you all operating outside Trading Standards Guidance? I do, however on page 13 of this document (available for review at http://pstatic.powys.gov.uk/fileadmin/Docs/Estate_Agency/NTSEAT_guidance_on_property_sales_-_Sept_2015_en.pdf) find reference to a MARKET APPRAISAL.

I don’t want to keep correcting you guys, so happy for you to prove me wrong. However on my initial search my point seems to be duly made. Now let’s start to solve the problem instead of ESTATE AGENTS CONTINUALLY TRYING TO ATTACK THE VALUERS!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“The Estate Agent provides a Market Appraisal and NOT valuation so as such how can a down-valuation occur? Also valuation is an opinion, so as someone says, 5% tolerance is not a down-valuation, it’s a difference of opinion.”

IF, as you say, “valuation is an opinion” – then you will have to concede that the valuer’s opinion can be wrong. You will also have to concede that the valuer’s ‘opinion’ can be influenced/corrupted by a number of factors – one of those factors can be and often is the constant issue of overriding pressure by their employers to ensure that backs are not only covered but armour-plated with added Kevlar for good measure to avoid future PII issues.

Is, in your opinion, YOUR ‘opinion’ as to value of a particular property, in a particular location, more or less likely to be wrong than that of the Estate Agent who listed and negotiated the offer on it? If the answer you choose to give is ‘yes’ – why do you say that and what do you offer as evidence to back up that statement?

To you, Sir/Madam…

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

To whom it may concern

If you disagree – then how’s about having the ‘nads (gender permitting) to debate your reasoning rather than simple enjoyment of one seconds’worth of that warm and fuzzy feeling when you hit the ‘Dislike’ button?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Has anyone thought about the basis of valuations might be different? If you are valuing as a security would you not be looking at the second purchaser. You could argue the true value of something is what 2 people would pay for it – depending how you view things. I suggest this as the first purchaser will almost always pay the highest price. As agent you will always put an optimistic price for marketing and allow it to be negotiated down. Some agents do not market at fixed prices and state offers in the region of £x do these agents not know the values? Having been around in a couple of the property crashes it is always the surveyors that the building societies sue for their losses so I understand their caution. What about sales incentives that are sometimes hidden in sales such as white goods etc. What about gazumping is this suggesting agents can’t value either?

I know agents will dislike my comments – I expect that but there are two sides to this. The fact surveyors seek comparable sales means they are probably trying to justify their valuation opinion not just trying to knock prices. If agent had to pay the same level of premiums surveyors are charged for their PII insurance.

Perhaps we all have mono vision seeing only that we want to justify our own standpoint.

I can now sit back and watch the dislikes! as I guess I might be too old by seeing both sides of an argument.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Particular problem for the valuer involved in newbuild apartment blocks in London .The larger ones where the timelag between launch and completion is often 2 years or more and usualy in phases have their own diffcilties So with HPI there is a discrepancy in prices beween phases 1,2 and the remaining unsold apartments.

As the development completion date hoves into view the owner- occupiers who are seeking to utilise the enhanced 40% deposits offered under the London Help 2 Buy arrive on the buying scene for those priced under £600k with developers signed up to the scheme which many are

The rules prevent the buyers from processing their application more than 6 months before completion Those who bought in Phase 1 at cheaper prices some of whom who will be specualtors looking to reassign will be conscious there is less than 6months before they have to dip into pockest to find completion monies which they might or might not have lined up

A new flurry of interest arrives in the development from potential buyers they cant tap into which must be frustrating

They cant sell to these new buyers fresh on the scene who can only buy direct from the developer This is more than likely to encouragethe motivated sellers from Phase 1 to chip their prices especailly as they bought more cheaply

Consequently the prices are all over the shop and the valuer will also be aware that the new owner-occupier once signed up if they wanted to sell would become a secondhand seller just like the new car driven out of the showroom instantly becomes scondhand and loses value. Very difficut to value where prices are in such a state of flux

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Over valuing seems to be a common occurrence where i am based. The amount of agents adding on an extra 15k+ (an agent added on an extra 70k once) to what other agents value the property at is insane. Of course, the vendors are over the moon with the valuation and decide to sell with said agent. Only a month down the line, it appears on Rightmove as reduced, and then again reduced a few weeks later.

It’s stupid, yet seems to be working and they’re obtaining quite a few properties from it.

If they’re lucky to sell for that over valued price, a surveyor will look at comparables and then see that the property that is in question is quite obviously well over what else has sold similarly. Surveyors are not to blame for down valuations.

What is there to do to combat these over valuing agents?

Maybe we should all start over valuing and winning instructions, guess that’s the ‘cool’ thing to do???

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

My simple and humble opinion……..

If a buyer is found (and this story stems from surveyor’s down valuing) then there is a fair argument the property is being purchased at a price someone was willing to pay and therefore that was the “worth” on the day.

Problem is, with such low stock and rising prices, comps are thin on the ground and if the surveyor has to provide 3 comps and 3 are not available what can they do…. low stock is making the comps hard, yet the reason for the high sale prices. Catch 22.

I feel the pain both ways really, but IF the poop hits the fan if the market falters we are very aware the surveyor and maybe even us (the agent) will now be in the firing line, I think we can get away with the argument we achieved our goal, found a buyer and we did not force the buyer to pay £x ….. but the surveyor on the other hand as a bigger issue.

Help the surveyor where you can pre survey, whatever made you put it on at a price might be enough for the surveyor and info they could not find. If we have no idea why we valued it at a price, then rightly we are in the firing line.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

In my experience, the only consequence of a property being “down-valued” is that they already financially stretched purchaser has to make up the shortfall in cash, or they have to run the gauntlet of applying to another lender and hoping it gets panelled out to different surveying firm. Everyone knows the surveyors in their area who have “form” for this type of thing.

The truth is that “laziness” is present in all professions! I once saved a potential down valuation by providing a comparable to a surveyor that was listed as under offer with a competitor on the same road which had fortunately just exchanged, the surveyor was completely unaware of it, despite it only being a few doors away from the house being valued, but was readily happy to judge it as being over £100,000 over price!

The surveyor thanked me for providing the price was upheld, and I was left extremely concerned!

Isn’t the real issue here that Lenders just aren’t paying enough of their mortgage valuation fee to the surveyors?

I know plenty of surveyors who won’t touch mortgage vals anymore because they don’t pay enough and the PI is monstrous, and with surveyors who are undertaking MV’s having to perform 8,9,10 valuations a day, do they really have time to research each one adequately? I can see the temptation to be ultra conservative, especially it’s a difficult one, but it really does cause a lot of stress for the purchaser who has to fix the problem ultimately.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Richard

Good reasoned response. Just so you know, as I often get provided with ‘under offer’ or SSTC properties as comparables. Yes they can factor into the decision of a Valuer, however they are not strictly speaking ‘strong’ evidence. For instance, what happens to the evidence of the property doesn’t sell and sells later for £XXXXX lower than the first SSTC sale price, should the Valuer have an opportunity to return to his opinion and change it?

You’re right, BTW as I’ve been one of those MV Surveyors tasked with a minimum target of 7 MVR’s per day, as well as everything else. It’s human nature to cut corners, find shortcuts or in the eventuality that it’s a difficult valuation, to be cautious (I was always taught to be so 😉

That said, the Valuer’s role is to do their best and most try to do so but when fees are constantly under attack and being lower, time pressure is higher, what do you (agents) expect to happen.

Hence why I’ve started this discussion off. We need as an industry to find solutions to the problem and not keep on berating each other. Does anyone have any?

I do, why not create an open and transparent database of sales where all property sales are listed (obviously not names of people), including asking prices, sale prices, etc… Rightmove does a reasonable stab at this, but there’s a lot of misinformation around so having something that was created and controlled by an independent Govt. controlled body might work. Discuss

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Hi Surveyor

Adding to Richard’s comment and confirming mine, I am not sure how “up to date” the surveyors database is, however my reference (not that you have questioned this) was providing comps where perhaps you have JUST exchanged contracts, as I assume exchanges that month are possibly nowhere to be seen be a surveyor. I say that month, possibly even the past couple of months.

Completely agree with you that, pre exchange can mean little, as it can fall through.

It’s a tough one this and I personally find most surveyors are as fair as they can be and often call you before they down value, if that is to be the end result, although less so of late, as I am finding more and more out of town surveyors valuing. I say out of town, out of county in some cases.

As for a database (here we go) OTM create software which works seamlessly in providing the live and real time completion information ahead of the game. (the game being the LR) Member agents agree with this and on completion the software triggers the info through to an OTM section showing this. OTM could have member info which is unique to them and give buyers a real reason to be seeing live as it happens info re completion prices. Just a thought.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Oh this story has rattled a few cages this morning. Often a property does need down valuing from the sale price for good reasons, typically poor condition/structural which vendor/buyer or agent was aware of (or turned a blind eye).

DEFINITION OF MARKET VALUE

The probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby: (1) Buyer and Seller are typically motivated; (2) both parties are well informed or well advised and each acting in what he/she considers his/hers own best interest; (3) a reasonable time is allowed for exposure in the open market; (4) payment is made in terms of cash in pounds sterling or in terms of financial arrangements comparable to; and (5) the price represents the normal considerations for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

The surveyors argument is over his/hers opinion and his/her remit with a particular lender as some are tougher on valuations than others. Simply put they know the value or they don’t. The latter nearly always leads to down value to cover their backs and reduce risk to their lender. If the lender doesn’t want to agree the loan based on the information supplied then they will not lend ….. or will they? Remember the days of being able to speak to the branch manager, now its a call centre with a “not showing on my computer, you’ll have to speak to the one of the other people you spoke to”. Valuation is subjective on a number of factors but I have never found a surveyor who has ever justified their valuation once the ink has dried, just “prove me wrong Mr Agent” and then his indemnity insurers start barking. What always throws a spanner in the works is a rising market where prices change from week to week even day to day. Who has the price right then!

A property market value is what someone is prepared to pay, period. If the lender doesn’t want to lend based on that price that they consider is to great a risk, find another lender … there is always one out there, often a lot. Just remember many surveyors use a data base and often can see when it was valued last week. Your right in it if the new lender calls out the same surveyor company. Years ago we banned certain surveyors after poor standards. The lenders were more than happy to use another surveyor.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Totally wrong! See my previous posts. Special purchasers (i.e. that SOMEONE you refer to) are discounted. Why why why so many confused Estate Agents on this topic, oh because they didn’t spend upwards of 5 years getting a Degree, obtaining Chartered Status of the RICS and/or working undertaking valuations for many years I guess, yet they seem to think they know more than those who did.

As I say, I’m not anti Estate Agent or anyone else, simply anti people who think they have the right to knock those trying their best to provide a client with a reasonable level of service in accordance with the guidance and rules they have to work within.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Maybe for once you will need to accept you are wrong and get off your horse as you shot yourself in the foot and clearly have an axe to grind with agents valuations. Not all agents over value a market appraisal, it is obnly when someone puts in an offer does one know if it was over valued or not. Agents do market appraisals, valuers ONLY do valuations based on risk to their client and formed from a matter of opinion. Often they get it wrong and some are darn right devious and hateful towards agents and love to throw a spanner in the works just for the hell of it …. I can write a book on the subject. Thankfully they are a minority. The definition of market value is legally accepted in most parts of the modern world. Valuation is a matter of opinion and everyone’s opinion is influenced. When surveyors can come up with a set formulae to value a property we will all be singing from the same hymn sheet, but that is impossible. The days of square meters went out with the ark, but it worked back then. Opinion “rules today” and people disagree.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“surveyor” a little patronising and contradictory…

“Provide comparable evidence yet don’t influence the surveyor”….Providing comparable evidence is doing precisely that, in fact my opinion on property values in the area I consistently work within every day is likely to be far more accurate that a surveyor who is covering a far vaster area and may not have valued a property locally for some time.

I think the attitude shown towards Estate agents in what I can only describe as this superiority super rant is very telling..

“all a bunch of lazy B*******” ” … “its time you all realised your job is to sell the property which includes doing some actual work”

“your role is to help and negotiate” (no s*** Sherlock)

“Help your client sell their property, don’t simply sit back and hope for the best then complain when you don’t get what you want”

I will halt my copy/pasting as there are far to many petty insults to list..

I work in excess of 50 hours a week…..I don’t knock off at 4pm….. I have pounded the street dropping leaflets, I have negotiated against my competitors to win the instruction, I have updated that client on an at least weekly basis, reassuring them they will sell, hand holding them if things have progressed quicker than they anticipated and encouraging them if things have progressed slower than they’d have liked, I have screened buyers and conducted viewings, checked financial status’s, I have then negotiated an agreeable price, I have then dealt with solicitors and lenders and other agents to secure the sale and the chain… what I haven’t done is taken a call from head office or a lender popped round at 10am, given the property an hour of my time, had a quick look at Rightmove/Land Reg before then tendering my opinion on a properties worth….

The number of times I have had to deal with a stroppy surveyor ringing me and asking if we can meet him at the property rather than him having to drive to our office to collect keys is uncountable….God forbid they have to drive three miles… Surveyors failing to turn up to appointments our homeowners have waited in for without even a call…….and I can count on my hand after fifteen years in the industry the number of times a surveyor has come back to me for further advice/comps when struggling to find supporting evidence before they decide to knock 20k of an agreed price…. nine times out of ten if I offer comps I am told they can find their own on line……

The reality is most agents work very hard to secure a sale, I for one will advise a vendor that a differing value at survey is a possibility if I feel we have achieved a price I may not be able to support with tangible evidence… the superiority complex, inflexibility once they have tendered their opinion and rudeness shown by this surveyor and many others is the difficult part of dealing with a down valuation, not the figure juggling or in most cases dealing with our clients….get of your high horse!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Not on a high horse, honestly and seriously no offence intended. I wrote the blog to spark debate and purposefully chose the phraseology and caps to do that. In which I’ve succeeded.

Now, as I’ve said above, let’s discuss a sensible solution and stop this Valuer bashing which I for one am totally fed up with and I’m not referring to this story but more generally.

I’m happy to work with any agent, give them the opportunity to help me help them if I can, along with being happy to try to resolve disputes and help my client in their purchase decision. All of this helps the agent, if only you guys would start to see it!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Who is your client?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Is this a “trick” question? As an agent my client is of course the vendor…..

I do not see “valuer bashing” as a common place issue, there are bound to be heated discussions and frustrations on occasion, this is par for the course surely… I genuinely do not feel agents are guilty regularly being rude or threatening to Surveyors.

I have read the thread of comments, with reference to ” agents don’t spend five years doing a degree”… “stupid estate agents” This in its self is a huge assumption, you know nothing about the educational level of the person sat in that chair as you walk into collect keys, I am a graduate and I have employed graduates.. We do help whenever we can, it would be self destructing not to!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

laahdeedah29

I believe that Mr May was asking ‘Surveyor’ who his/her client is, not your goodself.

If I’m wrong no doubt he will correct the assumption.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

<tempts fate>

It’s a wonder that Mr Hendry hasn’t posted his (most recent) thoughts on this… he’s been re-writing them for long enough!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I have come in late on this one, been busy!

I suppose the over valuations are not the result by any chance of the outrageous over valuations put on property by Poopla are they?

These overvaluations give sellers ammunition to hit us over the head when we tell them what we believe to be the right price to sell their property!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I know this is in the Archive – but it would be rude not to post this… for posterity!

Above, The Quirkster is quoted (and pictured for further proof in case he later comes as having said

“Many agents gratuitously over value just to gain stock. Even in a weaker market which is stupid. Surveyors can over-react too.”

SO… what about THIS property – http://www.rightmove.co.uk/property-for-sale/property-46822644.html – which has just been reduced by a mere ONE HUNDRED THOUSAND POUNDS from it’s original listing price.

Or THIS one – http://www.zoopla.co.uk/for-sale/details/42581277?search_identifier=07855cf95e3e9ac4d66e29b1e48afdea#XgDK0CvsgS05B8Gg.97 – which, at SEVENTY FIVE GRAND OFF the original listing price is an even higher percentage reduction than the above.

Of course, both of these pale into insignificance when you compare them to the examples that were Tweeted to them – but the bloke’s been MIGHTY quiet since…

…don’t you think?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

OPEN QUESTION TO ZOOPLA

In the Tweeted example above you can see that, in the case of the upper Price History the MOST RECENT reduction of £50,000 (21.7%) was seemingly made on 24th February, and the price shown was £180,000.

Could you please therefore explain why, as can be seen here –

http://www.zoopla.co.uk/for-sale/details/42580654#VPpjwSG1lBPLDMgK.97

– that reduction activity is no longer displayed, and is instead showing as a reduction of £57,001 (24.8%), made on 13 March?

SOMETHING’s not right. Or should I say something else…?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register